- Home - News

- TWI News | TV

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- News Videos | TV

- Photo Archives

- News Headlines

- Press Release

Business News of Friday, 21 April 2017

Source: starrfmonline.com

$2.25bn bond row will scare investors – Andani

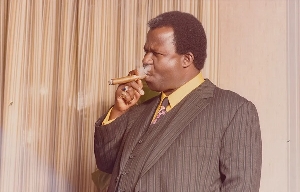

The president of the Ghana Bankers Association Alhassan Andani has warned that the controversies surrounding the 15-year domestic bonds issued recently by the government could spell doom for the economy.

The minority at a press conference Tuesday April 18, 2017 accused Mr. Ofori-Atta [the Finance Minister] of conflict of interest in the issuance of the $2.25 billion domestic bond, arguing that he has a relationship with majority buyer of the bond – Franklin Templeton.

The Minority’s accusation drew sharp rebuttal from the vice president Dr. Mahamudu Bawumia, who described the former’s stance as borne out of ignorance.

“It shows a lack of understanding. The minority has never understood this economy..It shows ignorance and I’m so sad this is coming from people who should know better,” Dr. Bawumia said of the Minority.

“Maybe they should read a little…” he added.

But speaking to Starr Business, the Managing Director for Stanbic Bank Ghana warned notwithstanding the denials from the Ministry and the vice president, the allegation could hurt the country’s reputation which might lead to a future flop in bond flotation.

He said: “My caution is that once a nation decides to play from the international capital market, we have to be sure that the participants and the people we are going to tap for resources on those international capital market are very monstrous company.

“They are huge companies with wide international reputations and therefore we have to be extremely careful if we are making any comment that’s going to impugn wrongdoing to especially the people we will go to, to raise capital at any point in time.”

“And in truth it is a party-insensitive…. It is about country reputation so those of us who report on these transactions let’s make sure that we are well informed. Otherwise if we just touch these people they will give anything up for their reputation and therefore we should be very careful the kind of commentary we are running around,” he added.

For him, “this will not be the first time or the last time we will go into the international debt capital market [and] if we say something we are not just hurting Templeton…we are probably passing a message on to other serious players which I don’t want to say but suffice to say let’s be very careful.”